Out-of-state buyers are increasingly drawn to the Black Hills, but many misunderstand the real Black Hills STR potential when evaluating properties. The region is high-demand, highly seasonal, and uniquely shaped by tourism cycles that don’t resemble typical vacation rental markets.

1. They Assume the Black Hills Is Only a Summer Market

Summer does produce the strongest occupancy, but buyers often overlook how year-round events, shoulder-season travel, and winter recreation shape demand. Towns like Hill City, Lead, and Custer continue to attract bookings well outside peak season.

Winter sports traffic, holiday travel, and regional road-trip culture support off-peak performance more than out-of-state investors typically expect.

To explore seasonality for your specific property type, try the Lunigo Revenue Calculator .

2. They Don’t Understand How Location Impacts Performance

The Black Hills isn’t a single market—it’s a collection of micro-markets with very different demand patterns. A cabin near Terry Peak performs differently than a home outside of Custer State Park, and both are different from a walkable spot in Deadwood.

Out-of-state buyers often underestimate how much proximity to trail systems, park entrances, or high-density tourism zones influences Black Hills STR potential.

When evaluating a property, compare it against local tourism drivers such as those listed by Black Hills & Badlands Tourism.

3. They Overlook the Power of Drive-to Travel

Unlike coastal or big-city markets that rely heavily on flights, the Black Hills benefits from a massive regional drive-to audience. Guests traveling from Sioux Falls, Minneapolis, Omaha, and Denver drive consistent demand throughout the year.

This stabilizes booking patterns and increases repeat stays—something many out-of-state buyers don’t realize until after analyzing market data.

4. They Misjudge Renovation and Design Needs

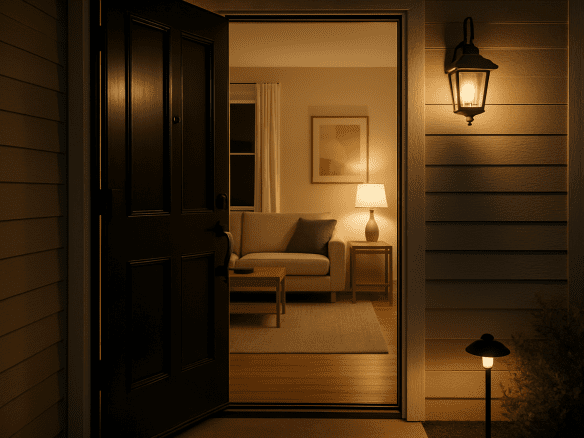

Many investors assume standard upgrades are enough, but the Black Hills traveler seeks a specific atmosphere: warm, scenic, cabin-forward, and curated to the natural environment. Properties that lean into modern mountain design consistently outperform generic rentals.

Understanding guest expectations in this region is essential. The right design choices can transform average performance into strong year-round revenue.

5. They Rely on Generic STR Data Instead of Localized Insights

National STR averages often misrepresent the Black Hills. Averages across the U.S. don’t reflect the tourism spikes driven by events like the Sturgis Motorcycle Rally, state park visitation, or local festivals.

Out-of-state buyers sometimes purchase based on broad occupancy or ADR numbers, missing the local nuances that determine real Black Hills STR potential.

Reviewing localized performance insights, comparable properties, and seasonal trends can paint a far more accurate picture.

6. They Underestimate the Complexity of Managing from Afar

Long-distance ownership adds operational challenges—especially in rural, high-elevation, or weather-variable areas. Quality oversight, local vendor relationships, and proactive maintenance routines become more important than in many urban markets.

Many out-of-state buyers discover too late that remote ownership requires a local infrastructure that’s already optimized for the region.

7. They Don’t Realize How Much Potential the Right Property Can Unlock

While some buyers underestimate the market, others underestimate what a well-positioned, design-forward, professionally operated property can truly earn here.

When a property is aligned with regional guest demand and maintained with consistency, the Black Hills STR potential can exceed expectations—even outperforming similar price points in other Midwest markets.

Get a Real Analysis of Your Property’s Black Hills STR Potential

If you’re considering buying or already own a property in the Black Hills, we can model its earning potential using local data, seasonal trends, and comparable performance benchmarks.

Get a Custom STR Evaluation